1. Eligibility & Requirements

Who Can Get a Mortgage?

• UAE Nationals

• UAE Residents (Expats)

• Non-Residents (terms and rates may vary)

• UAE Residents (Expats)

• Non-Residents (terms and rates may vary)

Are Expatriates Eligible for Mortgages?

- Properties ≤ AED 5 million: Borrow up to 85% for UAE nationals and up to 80% for expatriates.

- Properties > AED 5 million: Borrow up to 75% for UAE nationals and up to 70% for expatriates.

- Properties > AED 5 million: Borrow up to 75% for UAE nationals and up to 70% for expatriates.

Can Self-Employed Applicants Get a Mortgage?

• Banks review company structure, financial performance, and income stability

• We assist in selecting banks offering the best options

• We assist in selecting banks offering the best options

What Are the Age Requirements?

• Minimum: 21 years

• Maximum at loan maturity:

o UAE Nationals & Self-Employed Residents: 70 years

o Salaried Expats: 65 years

• Maximum at loan maturity:

o UAE Nationals & Self-Employed Residents: 70 years

o Salaried Expats: 65 years

What Are the Income Requirements?

• Salaried: Minimum AED 10,000/month

• Self-Employed: Minimum AED 25,000/month

• Self-Employed: Minimum AED 25,000/month

2. Property Types & Ownership

What Properties Are Eligible for Mortgages?

• Ready / completed units

• Off-plan / under-construction units

• Land plots

• Commercial properties

• Freehold & leasehold titles

• Off-plan / under-construction units

• Land plots

• Commercial properties

• Freehold & leasehold titles

What Is the Difference Between Freehold and Leasehold?

• Freehold: Full ownership of property and land

• Leasehold: Right to use property for a set period (usually 99 years)

• Leasehold: Right to use property for a set period (usually 99 years)

Can I Buy Land with a Mortgage?

• Land Only: Finance the purchase of a land plot. Ideal if you plan to build later.

• Land + Construction: Finance both the land purchase and the construction of a new property. Banks may require detailed construction plans and approvals.

• Land + Construction: Finance both the land purchase and the construction of a new property. Banks may require detailed construction plans and approvals.

3. Loan Details & Down Payment

What Is the Minimum Down Payment?

• UAE Nationals: 15% (properties ≤ AED 5M)

• Expats: 20% (properties ≤ AED 5M)

• High-Value Properties (> AED 5M): 25–30%

• Off-Plan / Under-Construction: 50%

• Expats: 20% (properties ≤ AED 5M)

• High-Value Properties (> AED 5M): 25–30%

• Off-Plan / Under-Construction: 50%

Can the Down Payment Be Financed?

• Must be paid upfront; cannot be financed

What Is the Maximum Loan-to-Value (LTV)?

• UAE Nationals: Up to 85% (properties ≤ AED 5M)

• Expats: Up to 80% (properties ≤ AED 5M)

• Non-Residents: Up to 75% (properties ≤ AED 5M)

• Expats: Up to 80% (properties ≤ AED 5M)

• Non-Residents: Up to 75% (properties ≤ AED 5M)

What Is the Maximum Loan Limit?

• Typically up to AED 25M; higher amounts possible with guidance

What Is the Maximum Loan Tenor?

• Up to 25 years, based on age at loan maturity:

o Expats (Salaried): 65 years

o Expats (Self-Employed) & UAE Nationals: 70 years

o Expats (Salaried): 65 years

o Expats (Self-Employed) & UAE Nationals: 70 years

What Is the Debt Burden Ratio (DBR)?

The DBR shows the maximum percentage of your monthly income that can be used to pay all your debts, including loans, credit cards, and your new mortgage. Banks usually consider up to 50% of your income to ensure you can comfortably manage your payments.

How Does a Mortgage Affordability Example Work?

Step Details Amount (AED)

1 Monthly Income 30,000

2 Maximum Allowable Debt (50% of income) 15,000

3 Existing Loan Payments (e.g. car loan, personal loan, credit card instalments) 5,000

4 Maximum New Mortgage Payment 10,000

What this means: Based on your income and existing debts, the bank estimates that you can afford a monthly mortgage payment of up to AED 10,000. Banks may also calculate payments assuming higher interest rates than today (e.g., 3.5%–8%) to ensure you could still manage the loan if rates increase in the future.

1 Monthly Income 30,000

2 Maximum Allowable Debt (50% of income) 15,000

3 Existing Loan Payments (e.g. car loan, personal loan, credit card instalments) 5,000

4 Maximum New Mortgage Payment 10,000

What this means: Based on your income and existing debts, the bank estimates that you can afford a monthly mortgage payment of up to AED 10,000. Banks may also calculate payments assuming higher interest rates than today (e.g., 3.5%–8%) to ensure you could still manage the loan if rates increase in the future.

4. Mortgage Process & Support

What Is the Mortgage Process & Timeline?

1. Pre-Approval – Confirm borrowing capacity

2. Choose Property – Pick a home within your budget

3. Valuation – Bank checks property value

4. Final Approval – Mortgage officially approved

5. Loan Disbursement – Funds released, ownership finalized

• Expected timeline: 7–50 business days

2. Choose Property – Pick a home within your budget

3. Valuation – Bank checks property value

4. Final Approval – Mortgage officially approved

5. Loan Disbursement – Funds released, ownership finalized

• Expected timeline: 7–50 business days

What Is Mortgage Pre-Approval?

• Bank’s initial check to determine borrowing capacity

• Benefits: Confirms your budget, strengthens your offer to sellers, and allows faster action when you find a property

• Valid for 60 days; pre-approval fee may apply

• Benefits: Confirms your budget, strengthens your offer to sellers, and allows faster action when you find a property

• Valid for 60 days; pre-approval fee may apply

Can You Get Mortgages for Multiple Properties?

You can apply for mortgages on more than one property, but eligibility depends on your income, existing debts, and bank policies. Each property is assessed individually, and banks may limit the total debt based on your ability to repay.

What Is a Top-Up Loan?

If you already have a mortgage, a top-up loan allows you to borrow extra money using the same property as security. The bank will revalue your property and check your income and existing debts. This is useful for renovations, buying additional items, or other personal needs without taking a new mortgage.

What Is a Buyout (Mortgage Transfer)?

A buyout allows you to transfer your existing mortgage from one bank to another to get better interest rates, lower monthly payments, or more favorable terms. The new bank will review your current mortgage, property value, income, and existing debts. This option can help you save money or improve your loan conditions without taking a completely new mortgage.

What Is a Mortgage for Property Handover?

This type of mortgage helps cover the final payment to the developer when your property is ready for handover. Both residents and non-residents can apply. The bank will assess your income, existing debts, and property value to provide the required funds. This ensures a smooth transition from construction completion to full ownership without needing to pay large sums upfront.

5. Rates & Special Options

What Are the Current Mortgage Rates?

Mortgage rates are the interest rates banks charge for home loans. Rates can change monthly and depend on factors such as your profile, income, property type, and loan amount. Our advisors can provide you with the latest rates from multiple banks and help you choose the most suitable option for your needs.

What Are the Types of Interest Rates?

• Fixed-Rate: The interest rate stays the same throughout the loan, so your monthly payments are predictable.

• Variable-Rate: The rate can change over time. It is usually calculated as “Prime Rate + Margin”:

• Prime Rate: The base interest rate set by the bank or benchmark (like EIBOR).

• Margin: An extra percentage the bank adds based on your profile and risk.

Example: If EIBOR is 4% and the bank adds a 2% margin, your mortgage interest rate will be 6%. This means your monthly payment can go up or down if EIBOR changes

• Variable-Rate: The rate can change over time. It is usually calculated as “Prime Rate + Margin”:

• Prime Rate: The base interest rate set by the bank or benchmark (like EIBOR).

• Margin: An extra percentage the bank adds based on your profile and risk.

Example: If EIBOR is 4% and the bank adds a 2% margin, your mortgage interest rate will be 6%. This means your monthly payment can go up or down if EIBOR changes

What Is EIBOR (Emirates Interbank Offered Rate)?

EIBOR is the benchmark interest rate at which banks in the UAE lend to each other. Many mortgages have variable rates linked to EIBOR, meaning your monthly payments can increase or decrease if EIBOR changes. Understanding this helps you know how interest rate fluctuations could affect your mortgage payments.

6. Insurance & Credit Checks

Do Banks Perform Credit Checks?

Banks check your credit history through the Al Etihad Credit Bureau (AECB) to see how you have managed past loans and debts. This helps them assess your reliability as a borrower. Individuals can also review their own credit reports using the AECB app to ensure all information is accurate before applying for a mortgage.

What Is a Credit Score?

Your credit score is a number that reflects your creditworthiness, based on your past loans, repayments, and credit card usage. Banks use this score to assess how likely you are to repay a mortgage on time.

• 700 and above: Excellent score; best chance of approval and competitive interest rates

• 400–699: Moderate score; eligible, but may receive higher interest rates

• Below 400: Low score; approval is unlikely

• 700 and above: Excellent score; best chance of approval and competitive interest rates

• 400–699: Moderate score; eligible, but may receive higher interest rates

• Below 400: Low score; approval is unlikely

What Insurance Coverage Is Required?

Life Protection Insurance: Ensures that your mortgage is fully covered in unexpected situations, giving you and your family financial security and peace of mind. It is usually required by banks.

Property Insurance: Protects your home or property against risks such as fire, natural events, or other damages. Some banks allow external insurance providers, giving you flexibility in choosing the best coverage.

Property Insurance: Protects your home or property against risks such as fire, natural events, or other damages. Some banks allow external insurance providers, giving you flexibility in choosing the best coverage.

7. Additional Considerations

What Is a Memorandum of Understanding (MOU)?

An MOU is a preliminary agreement between the buyer and seller that outlines key terms, conditions, and timelines of the property sale. It helps protect both parties by clarifying responsibilities and expectations before signing the final contract.

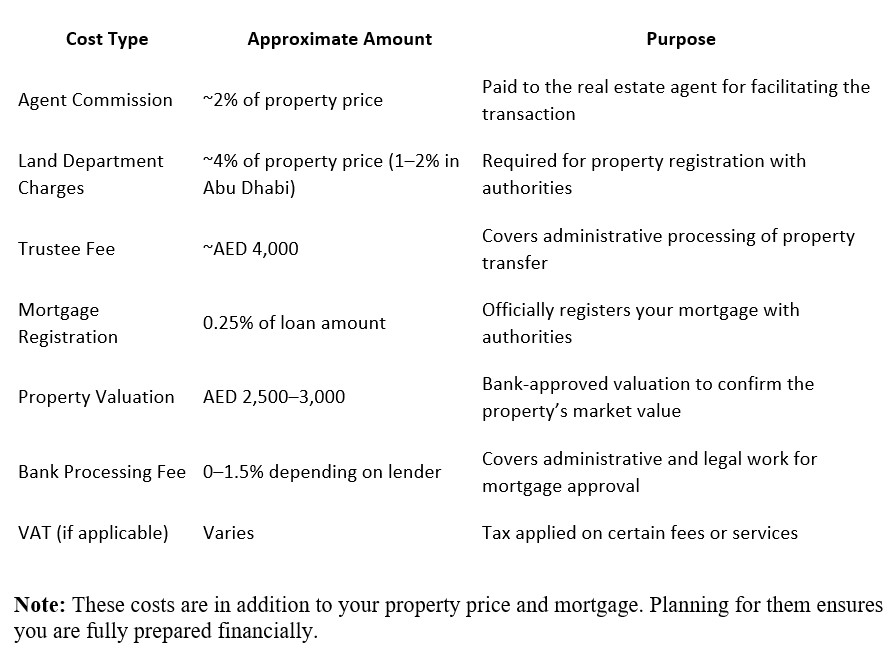

What Other Costs Should You Expect?

Can You Leave the UAE While Still Holding a Mortgage?

You can leave the UAE while still holding a mortgage, as long as all payments continue on time. Banks may require a local representative or proper communication channels to ensure timely repayment. Planning ahead helps avoid penalties or issues while abroad and ensures your mortgage remains in good standing.

8. Mortgage Brokers & Advantages

What Does a Mortgage Broker Do?

A mortgage broker is an independent professional who helps you find the most suitable mortgage for your needs. They compare multiple banks, explain the pros and cons of different options, and guide you through the application process, making it easier and faster to secure the right loan.

What Are the Advantages of Getting a Mortgage in the UAE?

Getting a mortgage in the UAE offers several benefits:

• High Rental Yields: Potential to earn strong rental income from your property.

• Property Appreciation: Real estate values may increase over time, growing your investment.

• Competitive Rates: Access to attractive interest rates from multiple banks.

• Flexible Payment Terms: Options to choose repayment plans that suit your budget and timeline.

• Access to Modern Real Estate: Opportunity to invest in new, high-quality developments with modern amenities.

• High Rental Yields: Potential to earn strong rental income from your property.

• Property Appreciation: Real estate values may increase over time, growing your investment.

• Competitive Rates: Access to attractive interest rates from multiple banks.

• Flexible Payment Terms: Options to choose repayment plans that suit your budget and timeline.

• Access to Modern Real Estate: Opportunity to invest in new, high-quality developments with modern amenities.

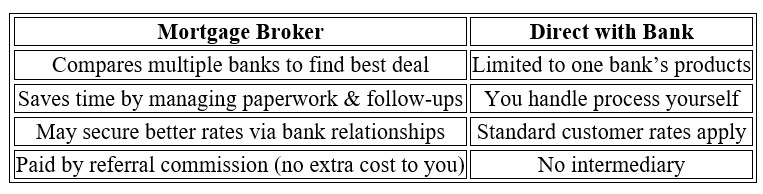

Should I Use a Mortgage Broker or Go Directly to the Bank?

• Conclusion: Choosing a mortgage broker gives you the advantage of expert guidance, access to multiple banks, and better rates — making your mortgage journey faster, easier, and more financially rewarding than going directly to a single bank.